Good day, brothers in investing! As you might have guessed by the title and this greeting, we’re going to talk about investment technicalities.

You might have heard the terms “short sale” or “short selling.” In recent years, these terms have become commonplace in news highlights due to controversial circumstances in the stock marketplace. But, what is a short sale and why should you avoid it? Let’s find out why!

Short Sale: The Basics

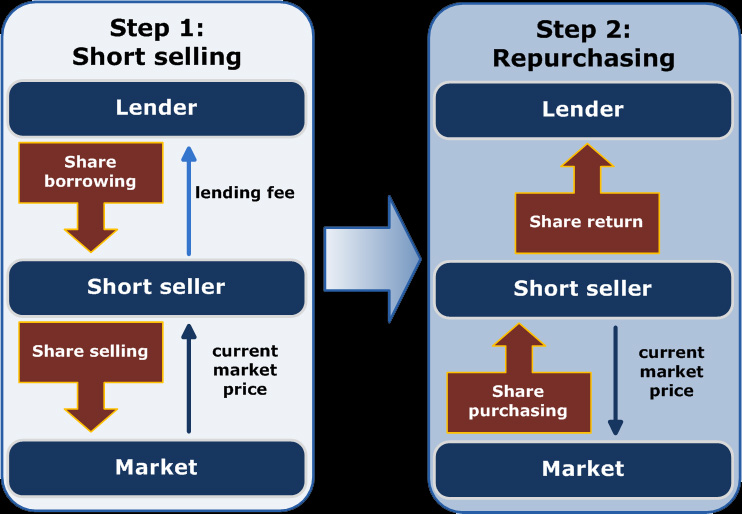

Straight away, let us define what exactly a short sale is. It is also referred to in the shorter (pun intended) slang term as a “short.” Essentially, it is borrowing to buy an asset, but deliberately making it drop in value. In other words, the investor borrows from the broker or lender and immediately sells the asset to turn a profit.

Once the value drops, the investor buys the lower-priced asset. The investor then returns the same amount of assets borrowed to the lender. The difference between the initially borrowed asset vs. the amount the investor bought at a reduced price then becomes the investor’s profit.

To illustrate, say for example you are interested in shorting a publicly-traded company with shares and stocks. You believe it will massively drop in price very soon. So, you borrow through a broker to buy 10,000 shares worth $5 each of the public stock of that company. Note that at this point, the investor has not spent any hard cash yet, but the asset is already under their name through the broker or lender and can be used for trade.

The investor (aka short seller) trades the 10,000 shares at the market at a value of $5 each. Within a day, the actual price of the stock drops and you buy the 10,000 shares for $3 each. You return the 10,000 shares to the broker. Thus, the investor profited the difference of the higher price from the short sale to the lower price (which in this example would be a profit of $20,000, not including any fees that might have been incurred in the process).

The Realities of a Short Sale

I’m sure you read that and went “wait, what?!”

Don’t worry. You’re not alone in being perplexed by how the short sale process works. After all, it does not make logical sense on the surface to borrow (and thus creating an outstanding liability) with the purpose of making an asset drop in value. It sounds like a terrible gamble. And actually, you would be right. It is a huge gamble.

But then, why would shrewd investors use this tactic? It is obviously a risky proposition. You would need to have advanced knowledge of how the market is trending, your possible avenues of approach, the specific dates when the asset would drop in value to time it correctly for borrowing from the lender, and many other factors. But the simple answer is this: big risk can bring big rewards.

On the other hand, the downsides can be big. If your forecast for the short sale is off, you would still have to pay the broker for the asset you borrowed. In a worst-case scenario, instead of the asset dropping in price, it actually increases! At which point, you would be compelled to buy the higher-priced asset to return to the broker or lender. That is going to sting your wallet, that’s for sure!

But that doesn’t stop big firms from conducting short selling. In fact, many of these firms conduct coordinated short selling on a massive scale. There are hedge funds and brokerages that do business in Wall Street that are specifically organized for this purpose. But what can this mean for the company’s targeted by such an underhanded strategy? In most cases, the targeted company suffers a terrible drop in corporate value. In extreme instances, that company will be forced to close.

Is a Short Sale Worth It?

It could be, at least in terms of profit. Depending on how much the difference between the value of the asset during the time it is borrowed, sold and returned, it could turn a great profit. Disregarding the fact that it is in a morally gray area, the return of investment might be worth the effort. However, the risks involved are undeniable.

The risks are such a concern that a broker or lender will have safeguards in place. Many brokers consider short selling as a margin transaction, setting the option for stop-loss orders. This allows the investor to take the risk and cover any initial cost that stops the trade if the asset rises in value. Of course, by going this route, the investor will have to cover that initial cost (which can range from 25% to 50% of the value).

But when the projections for short selling fail, it can fail significantly.

A great example is the GameStop Reddit Investors vs. Wall Street bigwigs controversy. In late 2020, the shares of GameStop shares rose in value due to a promising change in upper management. A conglomerate of Wall Street hedge fund firms saw an opportunity for a large short sale. This is because GameStop had already been experiencing business difficulties in the past several years. The firms projected that the short burst in share value would see an end fast.

However, a small group of investors in Reddit under the name “Wall Street Bets” decided not to let this happen. This group mobilized to invest in GameStop for the long term. As a result, GameStop’s share values reached sky-high proportions. Within a month, the short sellers lost billions of dollars while the Reddit investors became overnight millionaires.

Avoid Short Selling

Unless you are already a very experienced entrepreneur in playing the stock market, avoid short selling. There are too many variables that can go wrong. And if you go the other route by trying to counter a short sale, you need a support group.

But if you really think this might lead to a worthwhile payoff, then be prepared, my man. Listen, learn, study, and set backup plans if things go sour. And for more financial information and tips for the modern Alpha man, keep your eyes tuned to Malematter.com!